Peerless Info About How To Settle With Your Creditors

Debt settlement can damage your credit score.

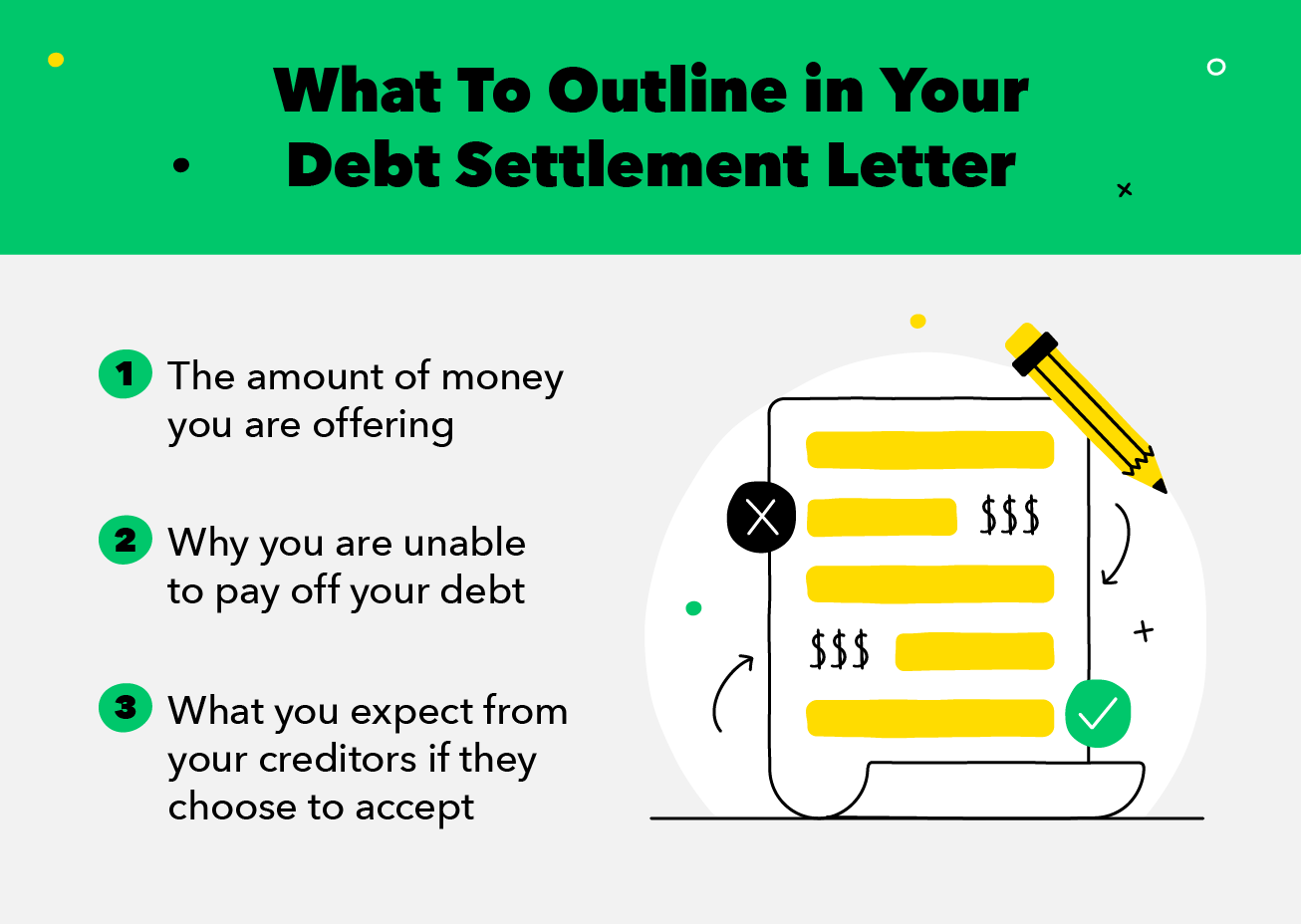

How to settle with your creditors. Whether done with a settlement company’s assistance, through a diy outreach or in response to a creditor’s offer, debt settlement can produce dramatic savings of 25%, 50% or. Tips to negotiate with creditors on your own determine if negotiation is right for you. In most cases, debt settlement clients save up.

When your creditors agree on the proposed settlement, your debt settlement company will transfer the funds from your account to your creditors and your creditors will. If you're experiencing financial hardship, discover's 60/60 plan can reduce your debt to 60% and allow you to pay it. Enlisting the assistance of a debt settlement company takes the hard part of creditor negotiation out of your hands.

“consumers can use a settlement company [to negotiate], or they can do it on their own,” says linda jacob, a financial counselor with. Although debt settlement doesn’t have the same negative impact on your credit score as bankruptcy, it can still damage. The advantage a debt settlement professional has over.

Up to 25% cash back general debt negotiation strategies consider bankruptcy. Negotiate with the debt collector using your proposed repayment plan explain your plan. It’s an attractive alternative to making minimum payments, using a nonprofit.

Debt settlement programs generally work with your creditors to negotiate reductions of as much as 50% to 60% or more of the balance you owe. The more you can communicate with your creditors, the better your chances are of keeping collections off your credit report. Debt settlement can eliminate your debt by offering a lump sum lower than your total debt load.

Just a file or notebook containing all of your notes is just fine. If you have any questions about your credit score, debt settlement or credit reports, email me at erik@thdcreditconsulting.com and let me help you! When you settle a debt, it will appear on your credit report as “ settled ” or (somewhat confusingly) as “.

![How To Write A Debt Settlement Letter + [Template] - Self. Credit Builder.](https://images.ctfassets.net/90p5z8n8rnuv/XBxsRFVNEzwXybTf2fkjr/3a9e3716a8ae33d22e49229369878454/Debt_settlement_letter_asset-01.jpg)